All things come to those that wait…

In about 1975, I was sitting at the kitchen table with my dad and he was listening to the radio. I heard the presenter say that in 1626, a dutch businessman had bought Manhattan Island for a bag of trinkets.

I didn’t really know what Manhattan Island was but I’d heard of it. I knew it was in America and it seemed to be tightly linked to sky scrapers, big companies and very rich people!

I was outraged! In my imagination, there was a despicable european guy tricking an innocent native american out of their birthright and probably laughing about it in an evil way!

I said as much to my dad and he told me that if the native american had sold the beads and invested the proceeds in stocks and shares, then the pot would now be big enough to purchase the island back!

I didn’t believe him and thought he was exaggerating to make the point that investing money over a long period can give exciting returns. I suspected that much at least to be true.

Fast forward to April 2020. We’re deep in Covid-19 lock down, and the stock markets have fallen by 35% or so. I was browsing through linkedin and I came across a post where a parent had combined his own free time with the need to educate his child and decided to look at compound interest. He asked for suggestions on how he could do it. Of course I had some time on my own hands too and remembered the conversation with my own father almost 50 years earlier. I knew it definitely couldn’t be true that the proceeds from the bag of beads invested over the years would be enough to repurchase the whole of Manhattan Island…. But I thought it might be fun to see how close it could get 🙂

First some facts…

A bit of Google Fu and a short while later I have the following:

- In 1626, Peter Minuit was the Dutch guy who led the purchase of Manhattan Island for $24 of trinkets. In 2020 money, that is worth just over £900

- According to Investopedia, if we wanted to (and could negotiate the deal) the cost to purchase all the residential property in Manhattan Island (at 2019 prices), it would cost approximately £460 Billion. Now that is quite a lot of money!

And a bit of maths:

I thought I’d have a look at the rate of return that would be required to turn $24 in 1626 to £460 Billion in 2020.

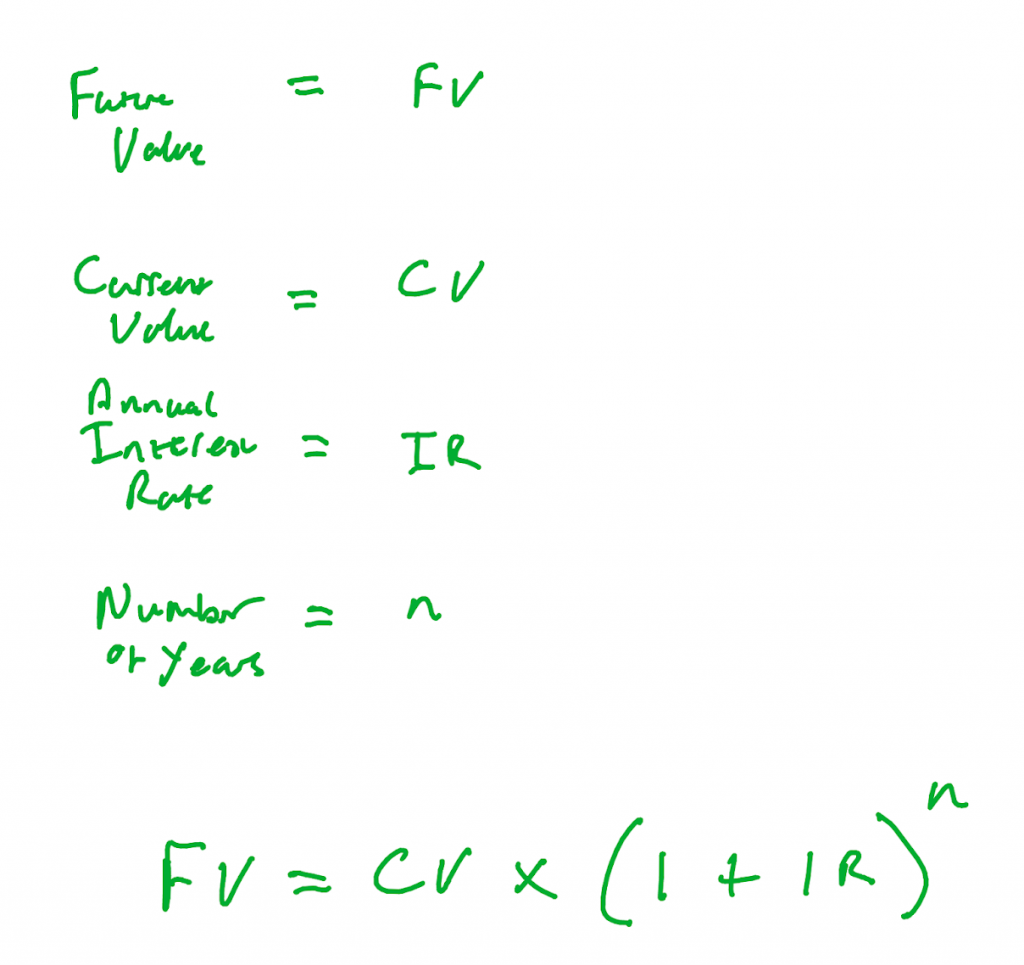

If:

- FV = Future Value

- OV = Original Value

- IR = Annual Interest Rate

- N = Number of years

Then we can quickly deduce that FV is the OV multiplied by (1 plus the IR) raised to the power of n

Or:

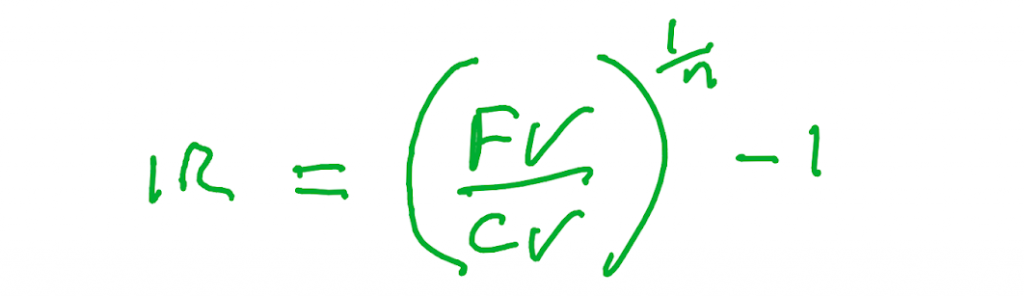

And using the power of formula transposition!!

If I convert $s to £s and use this formula, it tells me that the annual rate of interest that would be required to grow the investment from $24 to £460 Billion over a period of 394 years is 6.26%

That’s right! It’s only:

6.26%

It’s true that 394 years is a pretty long time but I was still really surprised and suddenly, my old dad didn’t seem quite so unbelievable!

Surely, it would be possible to get a return of 6.26%?

What rate might the investment have grown by?

I don’t have any figures for the performance of equity based investments that span a 400 year period but I wanted to get some idea of how stocks and shares have performed over the long term.

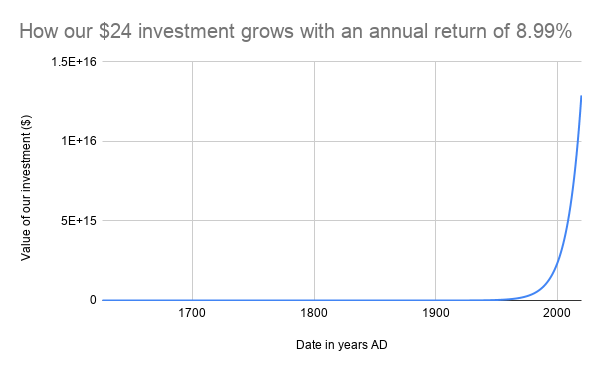

As I’m writing this from a UK perspective, with a bit more Google Fu, I found that the average total market return of UK Equities over the last 120 years is 8.9%. That’s through two world wars, a depression, a load of recessions, at least two deadly pandemics and plenty of other tough times.

Perhaps it’s not utterly outrageous to assume for a moment that those sorts of returns might have been available to the original seller if they had invested in a broad range of stocks in the UK market.

Just for fun, I thought I’d see what the result would be if that’s what they had done!

The results surprised me again.

They surprised me quite a lot.

8.99% is greater than 6.26% so it won’t be a surprise that it generated more than enough to buy all the residential property on Manhattan Island.

In 2017, the total value of all the property in the USA was estimated to be £132 Trillion. Our $24 has grown large enough that it could actually purchase all the property in the USA

In fact it’s grown more than that.

The same source estimated that the total value of all the property in the world was about £182 Trillion. We could buy all of it and still have change

A lot of change!

In fact, our investment would now be worth:

£10,319,112,475,260,100

In words that is: ten quadrillion,

three hundred and nineteen trillion,

one hundred and twelve billion,

four hundred and seventy-five million,

two hundred and sixty thousand,

And one hundred of our British pounds.

In my experience, there are very few people in the world who have the mental capacity to comprehend such a huge number just by reading it off the page.

So if we add all the property in the world, to all the gold ever mined to all the diamonds ever dug out of the ground, to all the oil ever extracted, we would have something like: £190,144,000,000,000

(£190 Trillion)

Our $24 investment could now purchase all of that 54 times over

I feel there’s not much I can say to that except: LOL LOL LOL!!!

Perhaps it would help if I included a quick graph showing how the investment would have grown from its humble beginnings

Footnote

If you’d like to see all the sources and calculations for this blog, please check out the google sheet where everything is stored here

Finally

These numbers are huge and if I had that amount of cash, I’d gladly pay it all to go back to our kitchen table in the early 70s and give my Dad a bit of support as he tried to educate a very scruffy and slightly sceptical teenager on the power of compound interest.

All things come to those who wait so perhaps one way or another I’ll get my chance!

If you’ve got your own business investment that you’re considering and you’d like some help in thinking how it might transform your business, please feel free to give me a call.

Peter Brookes-Smith

Curious problem solver, business developer, technologist and customer advocate

Other blogs by Peter

- Under the Tarpaulin Something Lurks

- Sign here…

- Legacy Applications – How did we get here and what can we do?

- Needles and haystacks or…

- The Case of Rev. Bayes v The Post Office

- Lighting a fire – Our first annual review…

- Helping Mine Detectors learn to use their equipment correctly

- How many?

- Finding defects with AI and computer vision

- Portfolio: PBS – Neural Net for Hand Written Digits

- CS50 – Harvard’s Open Computer Science Course

- What is a neural net anyway?

- Values Driven Business

- Monte Carlo or Bust!

- What is business agility? And why should I care?

- Are values in business our fair weather friend?

- Lessons in life from an ai agent

- Five tools for innovation mastery

- Value for money

- Award entry for European CEO Magazine 2017

- Darwin and The Travelling Salesperson

- What is this DevOps thing?

Blogs by other authors:

- From Stubble to Squad Goals: Our Mo-numental Mo-vember Mo-arvel!

- Learning a Foreign Language vs. Learning to Code: What’s the Difference?

- Solving complex problems through code – and nature!

- In it together – why employee ownership is right for us

- Old Dogs and New Tricks: The Monte Carlo Forecasting Journey

- Portfolio: Rachel – Photo Editing

- Portfolio: Luke – Hangman

- Portfolio: Will – Gym Machines